Finding a great credit card with a fair credit score can be challenging, but it’s definitely possible. Several options offer solid benefits even while you’re still improving your credit rating.

In this article, we’ll present the five best credit cards in the U.S. for people with fair credit scores, highlighting their main advantages and potential drawbacks.

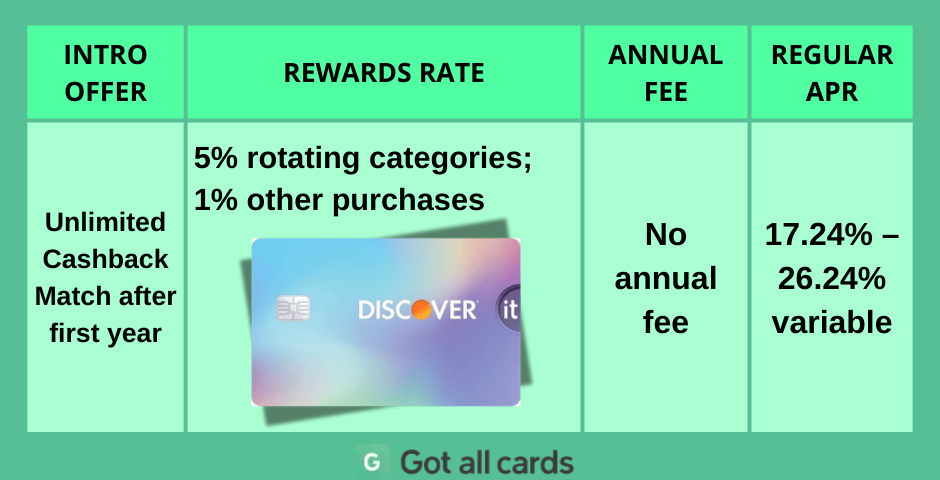

Discover It Student Cash Back

The Discover It Student Cash Back is perfect for college students aiming to build credit. It offers 5% cash back on rotating categories each quarter and doubles your first-year earnings.

Pros:

✅ Earn 5% cash back in rotating categories.

✅ Cashback match at the end of your first year.

Cons:

❌ Requires quarterly activation of categories.

❌ Quarterly spending limit capped at $1,500.

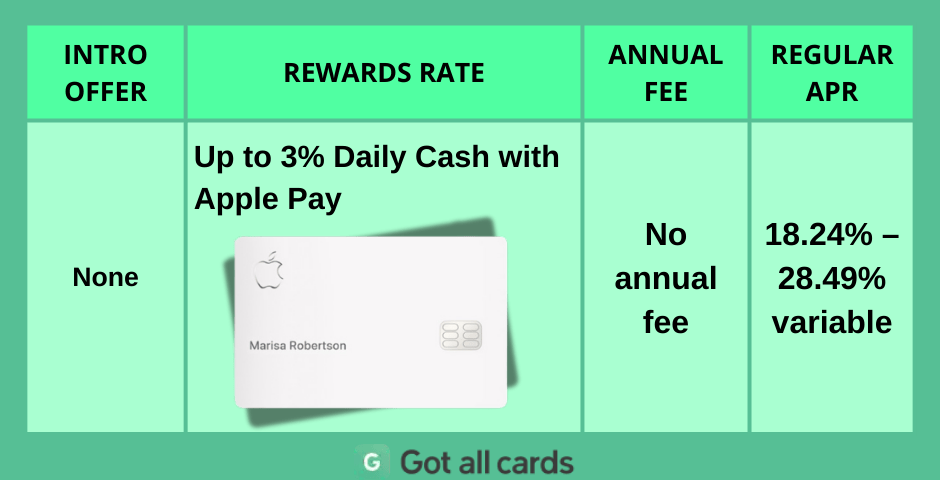

Apple Card

The Apple Card is designed for simplicity and digital convenience, offering daily cashback of up to 3% without annual or hidden fees. It’s ideal for Apple users.

Pros:

✅ Up to 3% daily cashback on Apple Pay purchases.

✅ No fees and easy-to-use budgeting tools on iPhone.

Cons:

❌ Requires Apple devices to fully utilize features.

❌ Highest cashback rate only applies when using Apple Pay.

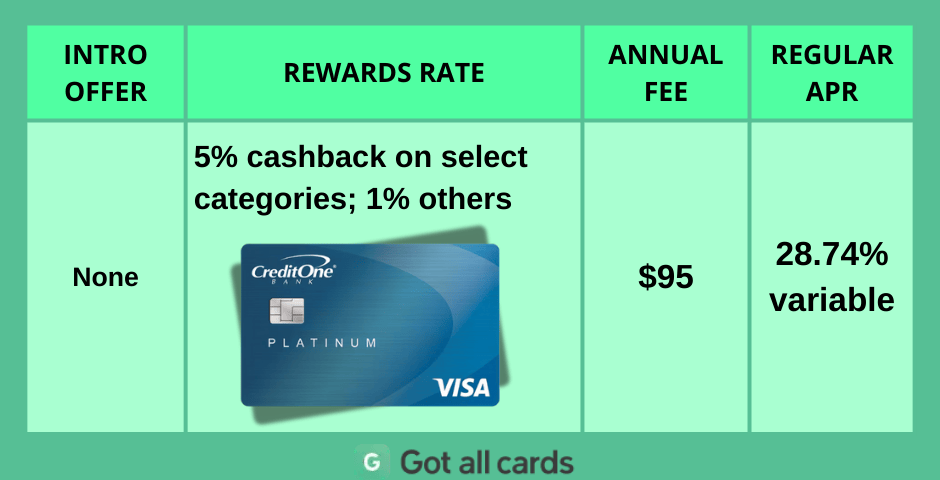

Credit One Platinum Visa

The Credit One Platinum Visa targets those looking to quickly improve their credit, offering significant cashback in essential categories such as gas and groceries.

Pros:

✅ 5% cashback on select categories like gas and groceries.

✅ Easier approval for fair-credit applicants.

Cons:

❌ Relatively high $95 annual fee.

❌ High variable APR of 28.74%.

Chase Freedom Unlimited

Chase Freedom Unlimited stands out with straightforward benefits and no annual fee, providing unlimited cashback starting at 1.5% on all purchases, plus higher rates in certain categories.

Pros:

✅ $200 bonus after spending $500 in the first 3 months.

✅ Unlimited 1.5% cashback on general purchases.

Cons:

❌ Requires good management to qualify for approval.

❌ Higher cashback (up to 5%) only through Chase Travel platform.

Discover It Secured Credit Card

The Discover It Secured is an excellent choice for those rebuilding credit, offering cashback rewards and a straightforward path to upgrading to an unsecured card after responsible use.

Pros:

✅ 2% cashback on restaurants and gas stations.

✅ Possible upgrade to unsecured card after 6 months of responsible use.

Cons:

❌ Requires a refundable security deposit of at least $200.

❌ Higher APR (27.24%) compared to unsecured cards.

Selecting the right credit card when your credit score is fair can significantly impact your financial future. Carefully weigh cashback offers, fees, and approval requirements to make an informed choice.

Consider your daily spending habits and priorities when comparing these options. Picking a card tailored to your needs can speed up the process of improving your credit score.

Taking smart financial steps today with these card options will help unlock better credit opportunities tomorrow.