When it comes to maximizing your travel experiences, choosing the right credit card can make all the difference.

Below, we explore some of the top travel rewards credit cards, highlighting their features, pros, cons, and key details.

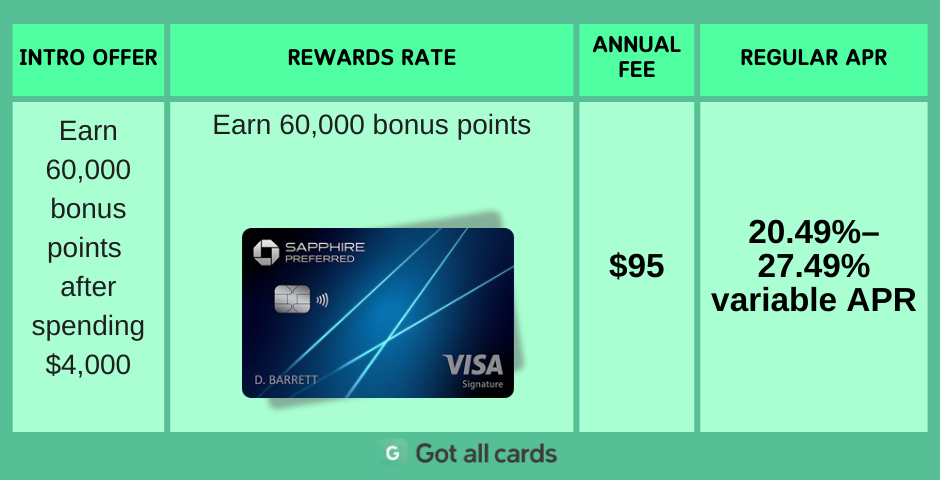

Chase Sapphire Preferred® Credit Card

The Chase Sapphire Preferred® Card is designed for travelers seeking to earn rewards on dining and travel purchases.

-

Pros:

✅25% more value when points are redeemed for travel through Chase Travel.

✅No foreign transaction fees.

-

Cons:

❌ $95 annual fee.

❌ Requires good to excellent credit for approval.

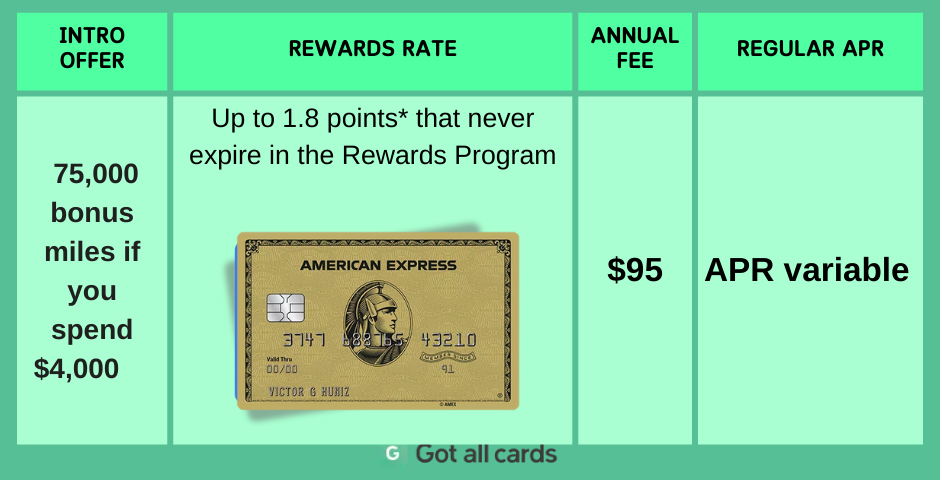

American Express® Gold Card

The American Express® Gold Card offers generous rewards for food lovers and travelers alike.

-

Pros:

✅High rewards rates on dining and supermarket purchases.

✅$120 dining credit and $100 airline fee credit annually.

-

Cons:

❌ $250 annual fee.

❌ Credits require enrollment and may have restrictions

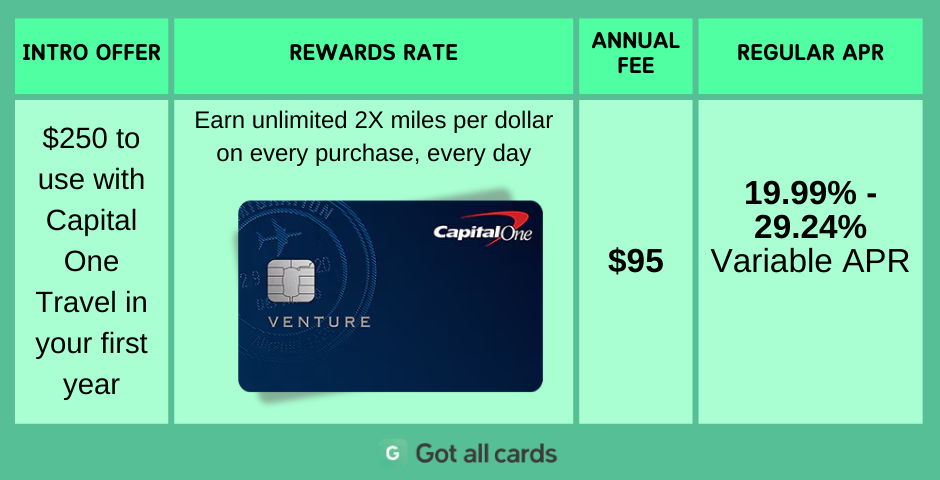

Venture Rewards from Capital One

The Venture Rewards Card from Capital One is tailored for travelers seeking straightforward rewards.

-

Pros:

✅Unlimited 2x miles on all purchases.

✅No foreign transaction fees

-

Cons:

❌ $95 annual fee.

❌ Limited travel transfer partners.

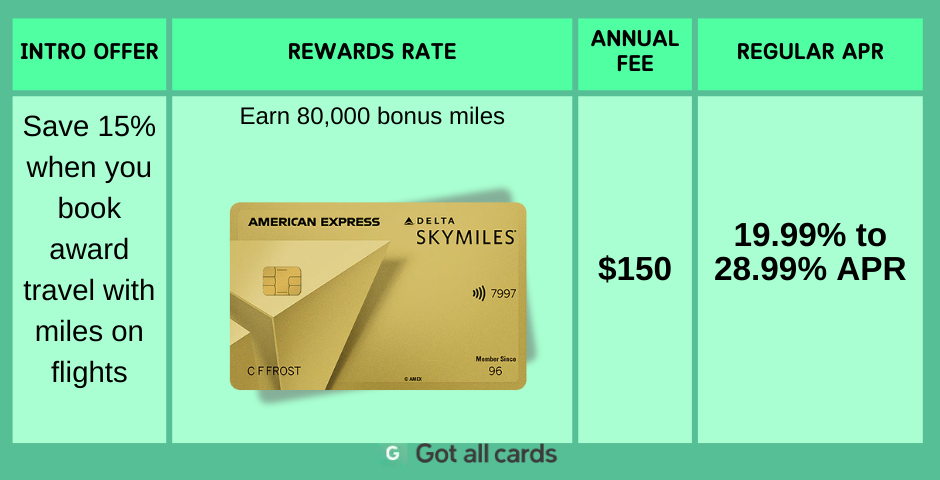

Delta SkyMiles® Gold American Express Card

The Delta SkyMiles® Gold American Express Card is an excellent choice for frequent Delta travelers, offering valuable perks such as a free first checked bag and priority boarding on Delta flights.

-

Pros:

✅First checked bag free on Delta flights.

✅Priority boarding on Delta flights.

-

Cons:

❌ $0 introductory annual fee for the first year, then $150.

❌ Miles redemption is best suited for Delta flights.

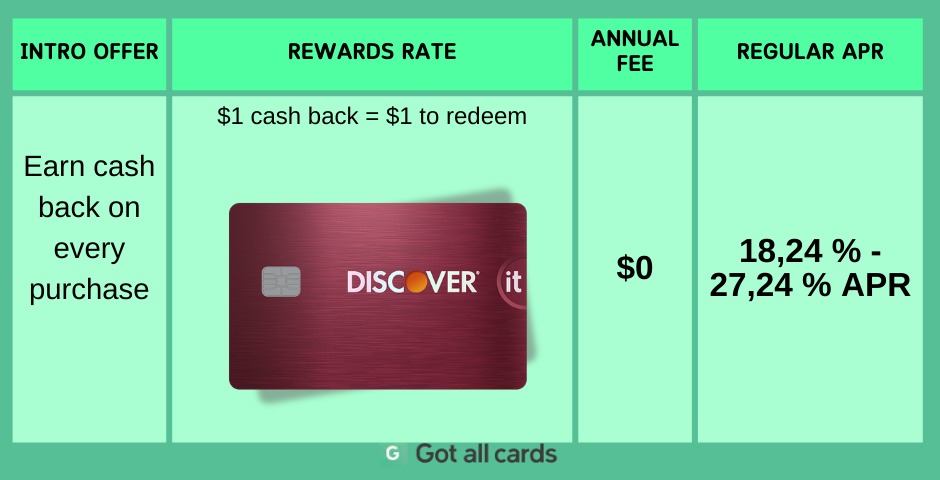

Discover it® Cash Back Credit Card

The Discover it® Cash Back Credit Card offers rotating quarterly categories where cardholders can earn 1% cash back.

-

Pros:

✅No annual fee.

✅Cashback Match™ at the end of the first year.

-

Cons:

❌ Requires activation for quarterly categories.

❌ 5% cash back limited to $1,500 in purchases per quarter.

Choosing the right travel rewards credit card depends on your spending habits and travel preferences.

If you prioritize flexible travel rewards, the Chase Sapphire Preferred® or Venture Rewards from Capital One are strong options.