What is the Maximum Credit Score and How to Achieve It?

If you’re working to improve your credit, you might be wondering what the highest possible credit score is and how you can achieve it. Having a high credit score opens the door to better loan rates, higher credit limits, and financial opportunities.

But what exactly is the maximum credit score, and what does it take to reach this ideal number? Let’s break it down.

What is a Credit Score?

A credit score is a numerical rating that reflects your creditworthiness, or how likely you are to repay borrowed money. Lenders use your credit score to determine if they should approve you for credit cards, loans, mortgages, or other forms of credit. Your score is based on several factors, including your payment history, the amount of debt you have, and the length of your credit history.

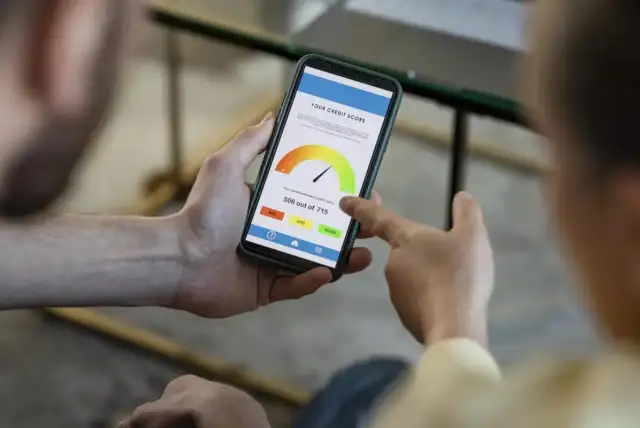

What is the Maximum Credit Score?

The most common credit score model is the FICO Score, which ranges from 300 to 850. In this system, 850 is the highest possible credit score. Achieving a perfect 850 score is rare but not impossible. Another common scoring model is the VantageScore, which also ranges from 300 to 850.

What Does a High Credit Score Mean?

A high credit score—generally considered to be anything above 750—signals to lenders that you are a low-risk borrower. It means you’re likely to pay your bills on time and manage your credit responsibly. People with high credit scores are more likely to be approved for loans and receive the best interest rates.

Factors that Affect Your Credit Score

Several factors contribute to your credit score, and understanding them can help you work toward a higher score. Here’s a breakdown of the most important elements:

- Payment History (35%)

- The most significant factor in your credit score is your payment history. Lenders want to see that you’ve paid past debts on time. Late or missed payments can have a significant negative impact on your score, while a consistent history of on-time payments will boost it.

- Amounts Owed (30%)

- This refers to the total amount of debt you currently owe. Having a high balance relative to your credit limit can lower your score. A good rule of thumb is to keep your credit utilization ratio below 30%—meaning you should try not to use more than 30% of your available credit.

- Length of Credit History (15%)

- The longer you’ve had credit, the better it is for your score. Lenders like to see a long history of responsible credit use. This factor considers the age of your oldest credit account, the age of your newest account, and the average age of all your accounts.

- Credit Mix (10%)

- Your credit score also takes into account the variety of credit types you have, such as credit cards, auto loans, mortgages, and retail accounts. Having a mix of different credit types shows that you can manage various forms of debt.

- New Credit (10%)

- Applying for new credit can lower your score temporarily. Every time you apply for a new line of credit, a hard inquiry is made on your credit report, which can negatively affect your score. Opening several new accounts in a short period can be a red flag for lenders.

How to Achieve the Maximum Credit Score

Reaching the maximum credit score of 850 requires near-perfect management of your finances. While it’s a difficult goal, here are some strategies to help you get closer to that perfect number:

- Pay Your Bills on Time—Every Time

- Since payment history is the largest factor in your credit score, paying all of your bills on time is essential. Even one missed payment can cause a significant drop in your score, so set up reminders or automatic payments to avoid this.

- Keep Your Credit Utilization Low

- Aim to keep your credit card balances as low as possible. Ideally, you should use no more than 10% of your available credit. For example, if you have a total credit limit of $10,000, try to keep your balance below $1,000.

- Avoid Opening Too Many New Accounts

- While it’s important to have credit, opening too many new accounts in a short period can negatively affect your score. Only apply for new credit when you need it and be cautious about having too many hard inquiries on your credit report.

- Maintain a Long Credit History

- The longer your accounts are open and in good standing, the better for your score. Avoid closing old credit accounts, even if you’re not using them, as this can lower the average age of your credit history.

- Diversify Your Credit Mix

- Having a variety of credit types, such as a credit card, car loan, or mortgage, can help boost your score. It shows lenders that you can responsibly manage different forms of debt.

- Regularly Check Your Credit Report

- Mistakes on your credit report can drag down your score. Make it a habit to review your credit report at least once a year to check for errors or signs of fraud. You’re entitled to one free credit report each year from each of the three major credit bureaus (Experian, TransUnion, and Equifax).

Why Does the Maximum Credit Score Matter?

Achieving the maximum credit score of 850 isn’t necessary to get the best financial deals. Most lenders consider a score of 760 or higher to be excellent, and you’ll likely qualify for the best rates and terms with a score in this range. However, aiming for the highest possible score is a good goal if you want to ensure financial flexibility and receive the most favorable loan terms available.

While a perfect credit score of 850 may seem like a distant goal, it’s achievable with responsible financial habits. By paying your bills on time, keeping your debt levels low, maintaining a long credit history, and diversifying your credit, you can work toward a high credit score. Remember, even if you don’t hit the maximum score, a score in the 700s or 800s will still put you in an excellent position to receive favorable loan terms and interest rates.