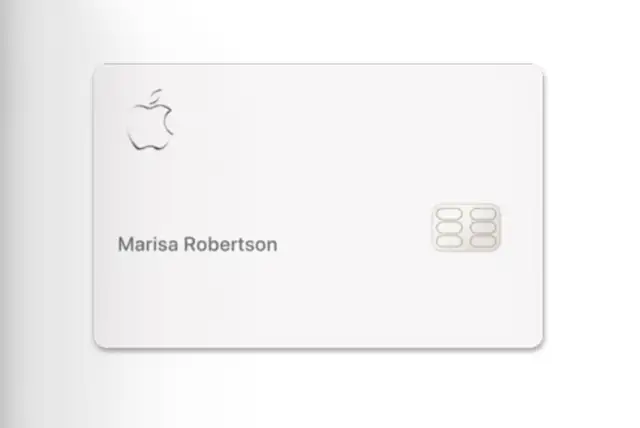

Ready for a credit card revolution? Meet the Apple Card, a game-changing credit card designed with you in mind. Hosted exclusively on your iPhone, this card combines seamless tech convenience with incredible financial benefits.

Enjoy up to 3% Daily Cash back on every purchase, zero fees, and a straightforward application process that won’t harm your credit score.

Why the Apple Card is for You

The Apple Card offers a level of transparency and convenience rare in the world of credit cards. With no annual, foreign transaction, or late fees, it’s designed to align with your financial goals, not hinder them.

Daily Cash is not just a catchy phrase; it’s a genuine, unlimited cashback on your purchases. Earn 3% on Apple products, 2% on Apple Pay transactions, and 1% on everything else.

Pros and Cons of the Apple Card

Before making your decision, it’s important to weigh the pros and cons:

Pros

- No Fees: Zero annual, foreign transaction, or late fees mean fewer financial headaches.

- Daily Cash: Unlimited cashback that quickly accumulates and can be spent or saved immediately.

Cons

- Apple Ecosystem: Maximizes benefits for users heavily invested in Apple products and services.

- Physical Card: Using the physical titanium card gives only 1% cashback, less compared to Apple Pay transactions.

How to Apply for the Apple Card

Ready to transform your credit experience?

Click the button below to discover more details and get started on your Apple Card application. Don’t miss out on the future of convenient, secure, and rewarding credit!