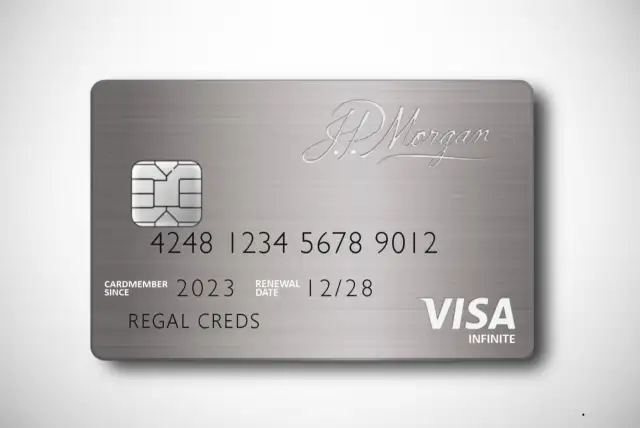

Owning a credit card is one thing, but having a JP Morgan Reserve Card is a whole different level of exclusivity. Designed for ultra-high-net-worth individuals, this card is available by invitation only to those with at least $10 million in assets under JP Morgan Private Bank.

Beyond its exclusivity, the JP Morgan Reserve Card is crafted from palladium and brass, exuding sophistication and prestige. But is it really worth it? Let’s explore.

Why the JP Morgan Reserve Card is for You

The JP Morgan Reserve Card is more than just a status symbol—it provides access to premium travel and lifestyle benefits. Holders enjoy unlimited access to airport lounges, a $300 annual travel credit, and 10X points on hotel and car rentals when booked through Chase Ultimate Rewards.

While the card may not have unique perks compared to other luxury credit cards, the exclusivity itself is a major draw. If you’re already a JP Morgan Private Bank client, this card is a perfect complement to your elite financial portfolio.

Pros and Cons of the JP Morgan Reserve Card

Pros

- Exclusive Access – Available only to select JP Morgan Private Bank clients, making it one of the most prestigious cards in the world.

- Luxury Travel Benefits – Includes Priority Pass lounge access, elite hotel perks, and premium travel insurance.

Cons

- High Annual Fee – Costs $595 per year, making it more expensive than some alternative luxury cards.

- No Unique Perks – Most benefits are identical to those of the Chase Sapphire Reserve, which is available to the public.

How to Apply for the JP Morgan Reserve Card

The JP Morgan Reserve Card is exclusively available to JP Morgan Private Bank clients with $10 million+ in managed assets. If you meet this criterion, you may receive an invitation to apply. Click below to discover more about this prestigious card and see if you qualify!