Having an excellent credit score opens the doors to the best credit card offers available in the U.S. market. If you’ve reached this milestone, congratulations – you’re in for some amazing perks.

Choosing the right card can help you maximize rewards, save money, and enjoy premium experiences. Here’s our selection of the top credit cards tailored for those with excellent credit:

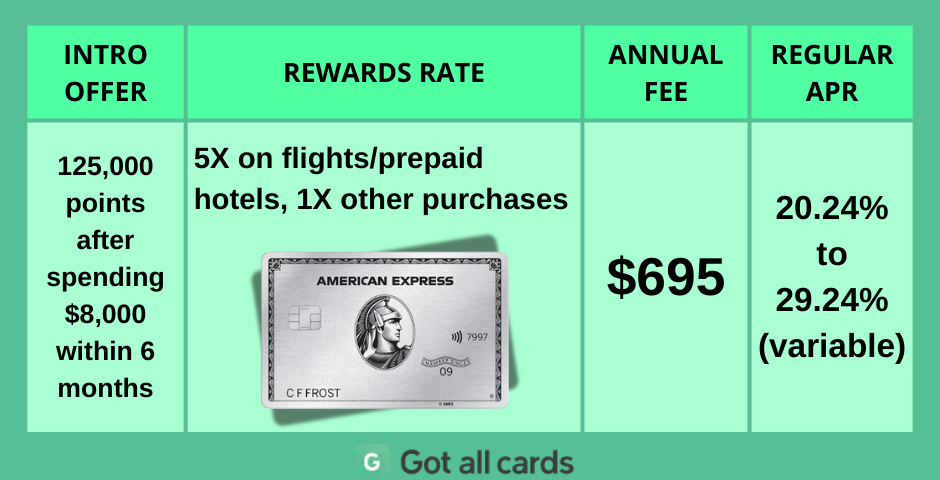

American Express Platinum

The Amex Platinum Card is renowned for luxurious perks like lounge access, valuable annual credits, and high rewards on travel-related spending.

Pros:

✅ Significant annual credits for hotels, Uber, airlines, and more.

✅ Exclusive access to the Global Lounge Collection with over 1,400 airport lounges.

Cons:

❌ High annual fee ($695).

❌ Requires high spending to maximize benefits.

Delta SkyMiles Gold American Express Card

Ideal for frequent Delta flyers, this card combines generous mileage rewards with travel perks such as priority boarding and free checked bags.

Pros:

✅ First checked bag free on Delta flights.

✅ Up to $200 annual Delta flight credit after spending $10,000.

Cons:

❌ Annual fee ($0 first year, then $150).

❌ Rewards mainly benefit Delta travelers.

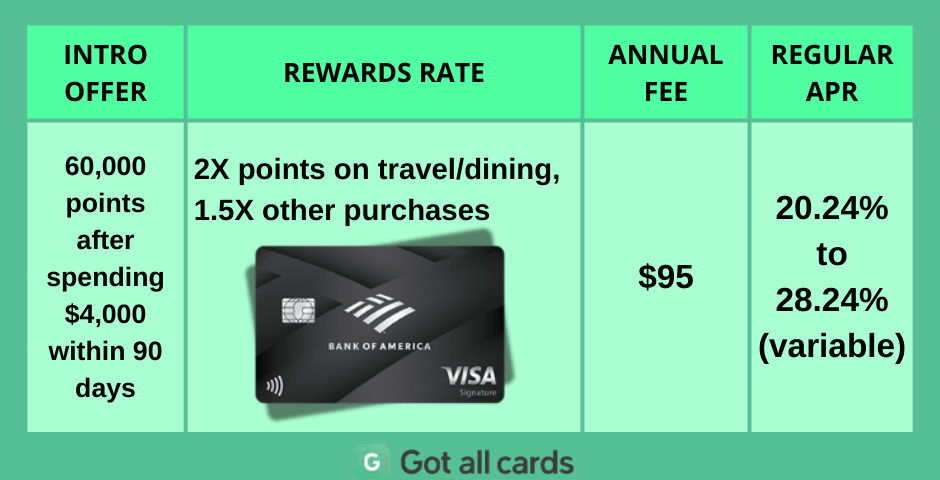

Bank of America Premium Rewards

The Bank of America Premium Rewards card is perfect for those looking for flexible points redemption across travel, cash back, and investments, combined with a moderate annual fee.

Pros:

✅ Earn up to 2 points per $1 on travel and dining.

✅ No foreign transaction fees.

Cons:

❌ Fewer premium travel perks compared to higher-end cards.

❌ Annual fee of $95 (though modest, still applicable).

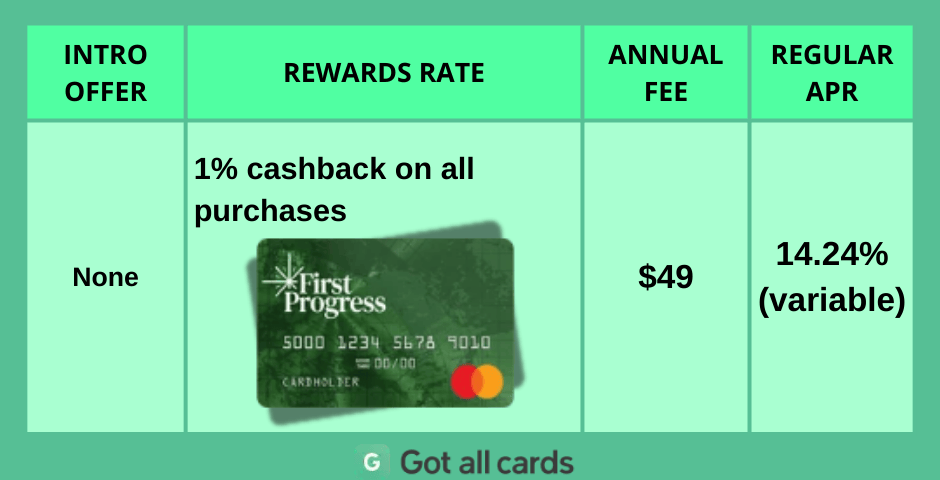

First Progress Platinum Prestige

A strong choice for building or rebuilding credit, this secured card offers low APR, credit reporting to all bureaus, and cashback rewards, even for those with limited credit history.

Pros:

✅ Low interest rate (14.24% variable APR).

✅ Accepts applicants with poor or no credit history.

Cons:

❌ Requires upfront security deposit.

❌ Credit limit tied directly to your deposit amount.

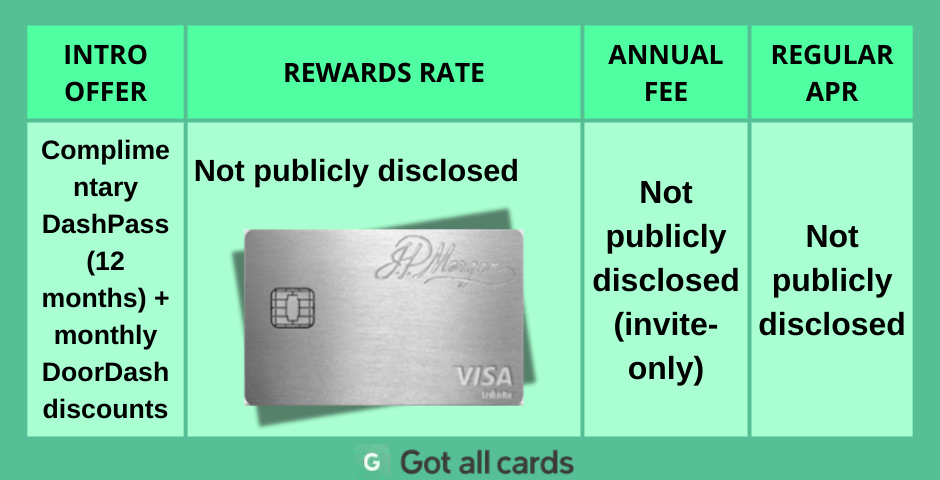

J.P. Morgan Reserve Card

Available exclusively by invitation, the J.P. Morgan Reserve Card offers ultra-premium experiences, including complimentary DashPass membership and VIP event access via Chase Experiences.

Pros:

✅ Complimentary DashPass from DoorDash for at least 12 months.

✅ Exclusive benefits through Chase Experiences.

Cons:

❌ Invitation-only card.

❌ Limited publicly available details about rewards and benefits.

Choosing the right credit card when you have an excellent credit score is a great way to maximize your financial advantages.

Carefully consider which of the above cards best fits your lifestyle, spending habits, and reward preferences.

Take into account the unique perks and the spending categories you prioritize most. Premium rewards often come with higher annual fees, but the benefits usually outweigh the costs if used wisely.

Now that you’re informed, you’re ready to select the perfect credit card for your needs. Apply today and start maximizing your rewards and benefits!