Choosing the right credit card is essential for building or rebuilding your credit history.

Below is a selection of credit cards designed to assist individuals with low credit scores, each accompanied by its key features, pros, and cons:

Capital One Quicksilver Secured Rewards

- Pros:

✅ Unlimited 1.5% cash back on all purchases

✅ No annual fee

- Cons:

❌ Requires a minimum refundable security deposit of $200

❌ High variable APR at 29.74%

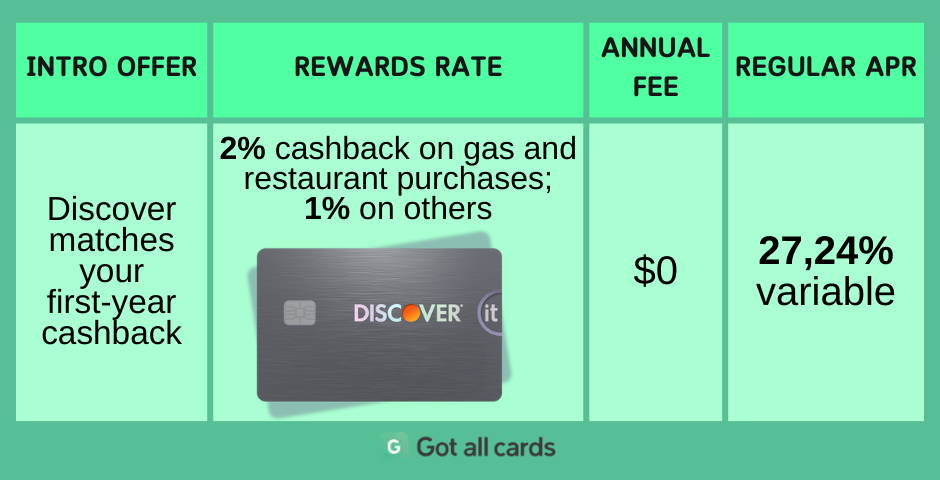

Discover it Secured Credit Card

The Discover it Secured Credit Card helps individuals build or rebuild their credit while offering cash back rewards.

- Pros:

✅ Cashback Match at the end of the first year

✅ No annual fee

- Cons:

❌ Requires a refundable security deposit

❌ Higher rewards limited to specific categories with quarterly caps

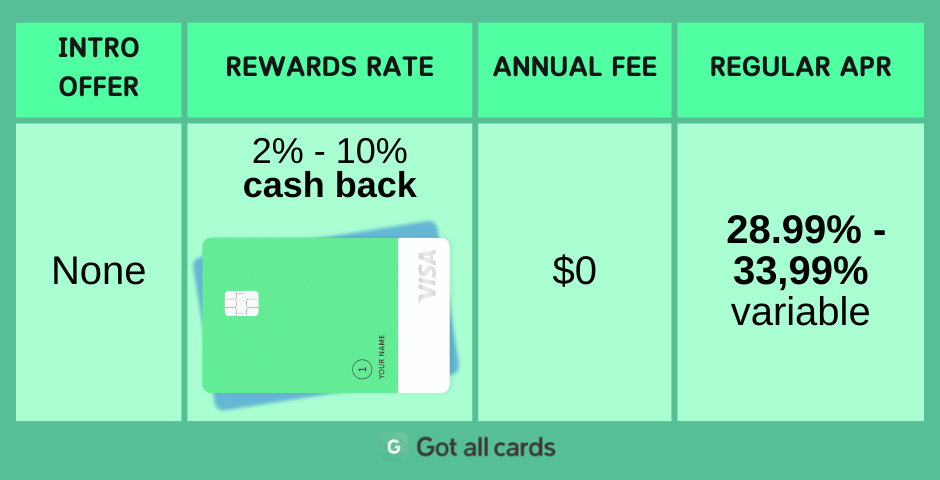

Petal 1 “No Annual Fee” Visa Credit Card

The Petal 1 Visa Credit Card is designed for those with limited or no credit history, offering cash back rewards without requiring a security deposit.

- Pros:

✅ No annual fee

✅ No security deposit required

- Cons:

❌ Variable APR can be high, depending on creditworthiness

❌ Cash back rewards limited to select merchants

Self Visa Secured Credit Card

The Self Visa Secured Credit Card is part of a credit-builder account, allowing individuals to build credit while saving money.

- Pros:

✅ Designed specifically for building credit

✅ Reports to all three major credit bureaus

- Cons:

❌ $35 annual fee

❌ Does not offer rewards on purchases

OpenSky Secured Visa Credit Card

The OpenSky Secured Visa Credit Card requires no credit check for approval, making it accessible for individuals with no or poor credit history.

- Pros:

✅ No credit check required for approval

✅ Flexible credit limits based on the security deposit

- Cons:

❌ $35 annual fee

❌ Does not offer rewards on purchases

Choosing the right credit card can be a powerful step toward improving your credit score and achieving financial stability.

Whether you opt for a secured card with cashback rewards or a no-annual-fee option designed for beginners, it’s important to use your card responsibly.

By carefully comparing features such as security deposits, rewards, and approval requirements, you can select a card that supports your credit-building journey while also providing valuable benefits.

Count on us to help you find the best credit card for you!